Financial Technology smartphone apps are plentiful. We weeded through the clutter of new and exciting finances apps and selected five that we think are worth taking for a test-drive.

- Nubank

Primary Use: Online banking app based out of Brazil that shows saving balances, credit cards and rewards.

Years on Market: 8 years

Cost: Fixed fees for fund withdrawals

Why We Like It: Very easy to use, reward program, zero transaction fees

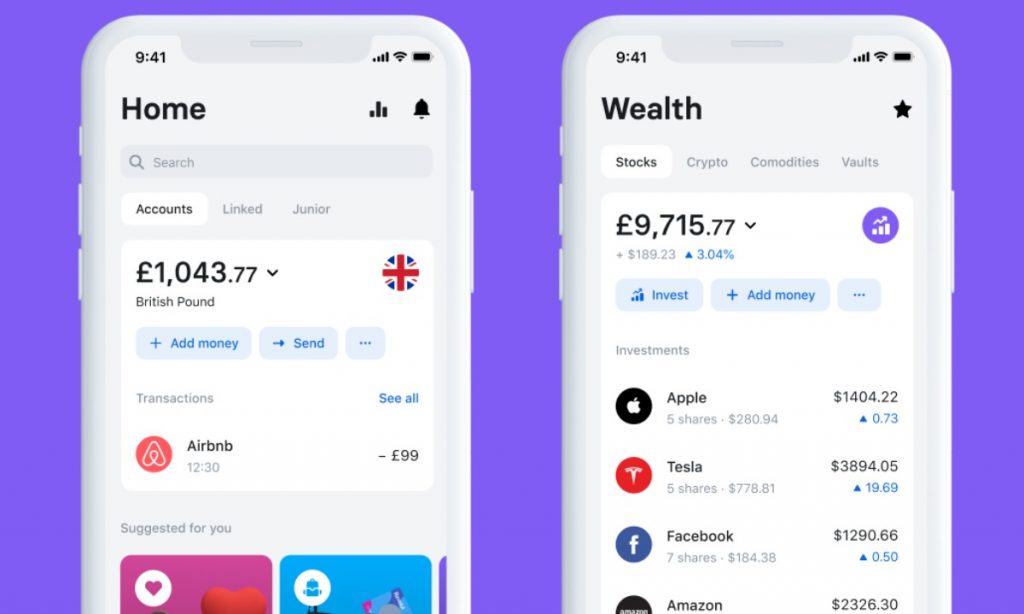

2. Revoult

Primary Use: Banking services and finance management app based in the UK

Years on Market: 6 years

Cost: Free

Why We Like It: Currency & cryptocurrency exchange, P2P payment systems, budgeting, bill splitting feature, overseas travel insurance

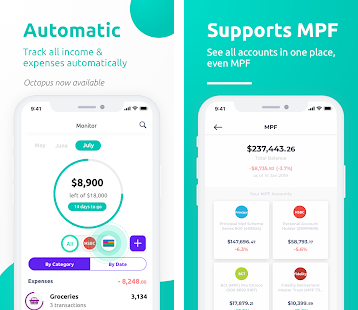

3. Planto

Primary Use: Personal finance management app based in Hong Kong used to set financial goals, track expenses, and budget

Years on Market: 3 years

Cost: Free to install + some features require subscription fees

Why We Like It: Can aggregate numbers from all financial accounts, app provides savings advice and insights

4. Chime

Primary Use: Mobile banking app for managing expenses and savings

Years on Market: 9 Years

Cost: Free

Why We Like It: No ATM fees, automatic savings deduction, no costs for friends & family transfers

5. MoneyLion

Primary Use: Mobile banking app used for savings, lending, and wealth management.

Years on Market: 6 Years

Cost: subscription-based model

Why We Like It: Everything in one place, cashback rewards (~12%), no checking fees, quick transfers, easy to use